In the last week or so there has been a significant amount of focus placed on RBS after it suffered a catastrophic IT failure that froze the accounts of 17 million customers and put billions of transactions on hold for several days.

Widespread coverage in the press and the vital nature of the services which RBS and its associated financial organisations provide meant that the whole situation has been painful for customers and embarrassing for those in charge.

The Guardian reports that the IT issues are still ongoing for some customers of the Ulster Bank, with RBS admitting that systems might not be back to normal until the 16th of July.

This incident has thrown up plenty of questions about exactly what went wrong, but more importantly it has highlighted the potential impact that can be made on a business if a critical IT system fails.

While you might expect a large firm such as RBS to look seriously at the issue of system resilience and disaster recovery, it is clear that its efforts were not good enough to prevent the disaster. It has even been claimed by sources quoted in The Register that major spending cuts in RBS’ domestic IT support team contributed to the problems, with outsourcing to India resulting in a lack of skilled workers operating in this area.

It is reported by the Telegraph that the cause of the IT glitch that disrupted the normally stable system is rooted in a routine upgrade procedure that was designed to improve the service afforded to customers, not freeze them out of their accounts.

It is worth noting that other IT failures have impacted banks, with HSBC customers suffering from an ATM glitch towards the end of 2011 and again in May of 2012, which meant that making a withdrawal from a cash machine was nigh on impossible.

At the moment, it is admittedly difficult to identify precisely what went wrong in the RBS debacle and, more importantly, how it might have been avoided as well as who should take the blame. While chief executive Stephen Hester has issued an apology to customers, he and his group are denying the claims relating to the idea that the fault lies with the outsourcing of IT to India.

However, there are certainly some lessons that can be drawn from this incident, most of which will help to spread the message of system resilience, which can be applied to businesses of all sizes.

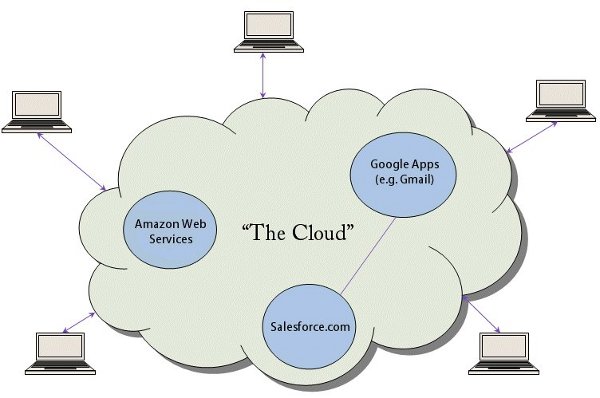

No matter what the scale of the operation, it seems that is should be necessary to preserve business critical services and data on platforms that are able to survive disasters and glitches of this kind. This might involve keeping multiple backups on different servers or, more conveniently, having access to a cloud computing platform which can be brought into action should in-house, private solutions fail for some reason or other.

More and more industry insiders will no doubt begin to tout the benefits and importance of investing in resilient systems. This is particularly apparent in the financial sector because electronic banking services have become a utility that is every bit as important as electricity or water.

Turn off the supply and millions of people will suffer, with horror stories already emerging about people going out of business because payments were not made in time by RBS and its associates.

Ideally, in the wake of this catastrophe, there will be a new culture that focuses on IT resilience rather than cutting corners to the detriment of the service as a whole.

Daisy Group plc provides resilient and secure business cloud hosting services, including Colocation, Data Centre and Cloud Computing services for Corporate, public sector and enterprise companies. With four Tier 3 UK Data Centres in Manchester, Jersey, London and Southampton all providing 24/7 support 365 Daisy is the natural choice for business hosting solutions.