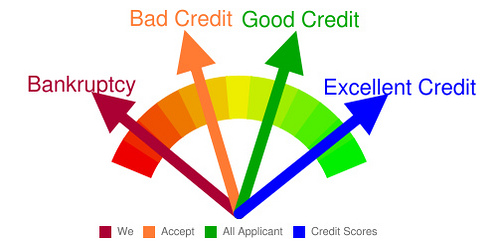

There are innumerable consequences to being convicted of driving under the influence (DUI). Many of these consequences, such as fines and jail time, are obvious but in reality, there are many other repercussions that a person may never expect. One consequence that’s often overlooked and rarely recognized until it’s too late is the effect that a DUI conviction can have on a person’s credit score. Though DUIs don’t directly show up on a credit report, they can indirectly have negative consequences on it.

Court Fees

The reality of the situation is that the failure to pay court fees can result in a person’s credit score going down. Most people know some of the consequences, such as a probation violation, that they could face by not paying the fines issued to them as part of their conviction. What they may not know is that courts will often report this failure to pay to credit agencies. Since this is, in essence, a failure to pay a debt, it will almost certainly result in a lowered credit score.

The importance of securing an attorney where you live, such as an Orlando DUI lawyer if you are in central Florida, can make the difference in the outcome of a DUI, including higher court fees.

Loss of Employment

The aforementioned fees can be difficult, but most people can handle them if they’re able to sustain consistent work. Unfortunately, a DUI conviction can make this excessively difficult to accomplish. A person will likely lose their license after convicted, and getting to and from work without the ability to drive can quickly become a burden on the accused and their family.

Additionally, a job that requires driving will automatically become impossible due to the license loss. Sadly, this loss of income will occur right when a person needs that income the most. The inability to earn wages equates to the inability to pay court fines and other debts, and this is nothing more than a recipe for a quick reduction in one’s credit rating.

Lawsuit Costs

Another huge cost that many people don’t anticipate is the financial burden that can come from facing a lawsuit. Alcohol is listed as the cause in nearly one-third of all accidents that lead to a death. Though a person can face serious liability if a death occurs due to their driving while intoxicated, it’s also a fact that a person may still face detrimental civil penalties if they injure a person who brings forward a lawsuit based on their negligence.

While it is true that most auto insurance policies will cover many of these costs even if the policyholder was intoxicated, it’s important to note that some companies have “operating under the influence” (OUI) exclusions in their policies. Additionally, due to the perceived gross negligence of causing an accident while under the influence, a person could face punitive damages in a lawsuit on top of compensatory damages.

While the additional damages may not seem important if a person is covered by their insurance, it’s imperative to remember that insurance policies have limits. If a person’s policy isn’t enough to cover all of the prescribed damages, which is often the case when state minimum coverage is purchased, that person could easily end up owing money from their own pocket. If these sometimes excessive costs aren’t paid for, serious damage can be done to a credit score.

Many people scoff at the thought that a DUI conviction can affect their credit rating, but when looking at all of the facts, there’s no doubt that the conviction can have long-lasting consequences. This makes it imperative for a person to initially plead not guilty to the charge and seek legal help as soon as possible. DUI attorneys know the best way to handle DUI charges in any situation, and if they can help avoid a reduction in a person’s credit score, then they were well worth the cost.

Felicia Willis is a blogger and editor from Atlanta, GA, who writes extensively about DUI. The Orlando DUI lawyer group of Katz & Phillips, P.A. offers creative and personalized legal assistance for people in the Central Florida area who find themselves facing a DUI conviction.

Photo credit: http://www.flickr.com/photos/matchfinancial/8738094449/