The financial services industry is not that different from many areas of the business world when it comes to its approach to cloud computing. These types of company look to the cloud in order to add value to their business while simultaneously reducing the costs associated with critical IT systems.

Companies that operate in the financial services industry may have additional concerns when it comes to cloud adoption, because compliance with rules laid down by regulators will doubtlessly raise questions about security, responsibility and transparency. However, correctly harnessing the cloud will ensure that these subjects are clearly understood, because working with a reputable provider will eliminate any concerns.

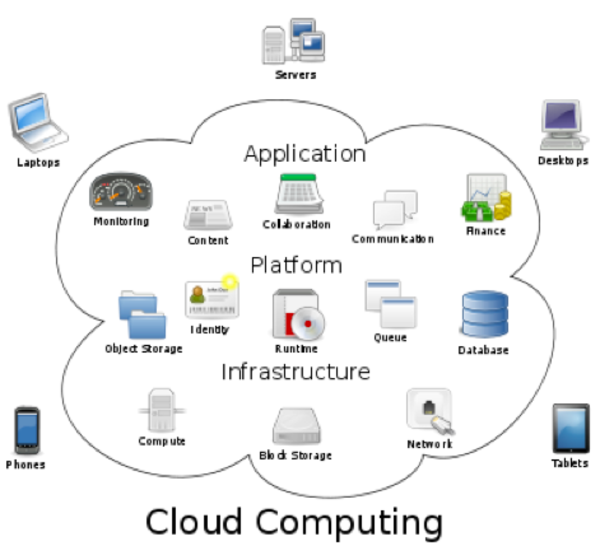

Here is a look at the different facets of cloud computing that can become particularly useful when applied in the financial services industry.

Scalability

The computational requirements of a company can vary from week to week or even minute to minute, with occasional spikes in usage requiring significant resources to be available on tap. Sustaining the kind of system that will support this in-house can be expensive and complicated, particularly if it would only be used to its full potential on a sporadic basis.

By running apps and services in the cloud it is possible to increase capacity in real time and only pay for what is required. Thus, remote servers packed with cutting edge processing hardware can deal with an influx of requests without crumbling under the pressure or being installed and maintained at direct cost to the company that is using them.

Continuity and Recovery

The cloud can be moulded to fit the requirements of any business, but an increasing number of companies are turning to this type of service in order to ensure that it is possible to sustain access to business-critical data and apps in the event of a disaster.

Whether the cloud is used to mirror an in-house store of backup data, or as the sole repository for information without which your business would falter, it provides a far more cost-effective solution for continuity and recovery than more traditional methods.

Virtualisation

For a company that could operate across multiple properties in various countries around the world, having a cohesive, universally accessible desktop set-up is only possible via the cloud. Whether you are entering new markets or accessing services from remote locations, the cloud’s virtualisation prowess will make sure that you can be up and running in as short a time as possible.

Because the cloud can deliver access to software as a service, the location of the end user and the type of device which is being harnessed are far less important.

Collaboration

The cloud is not only something that can benefit a business and its employees internally; if properly deployed, it can be a platform that actively engages clients, customers and business partners in a way that makes collaboration and continued relationships all the more appealing.

This is another feature which feeds into the scalability argument, because you need not worry about having the capacity to deal with new projects and accounts because the cloud provides it for you on tap.

Flexibility

The cloud is far more malleable than you might imagine and you rarely have to decide between using a private cloud solution or putting all your eggs in one basket with a public cloud service.

Many companies choose to approach the cloud using a hybrid set-up, which blends the best of private and public services in order to achieve a happy medium where things like security and privacy are assured, while scalability and business continuity are not adversely affected in the long run.

Daisy provides business cloud hosting services, colocation data centre and cloud computing services for Corporate, Public Sector and Enterprise Companies. With four Tier 3 UK Data Centres in Jersey, Manchester, London and Southampton which provide 24/7 support 365 Daisy are the natural choice for business hosting solutions.